Oklahoma Sales Tax Calculator

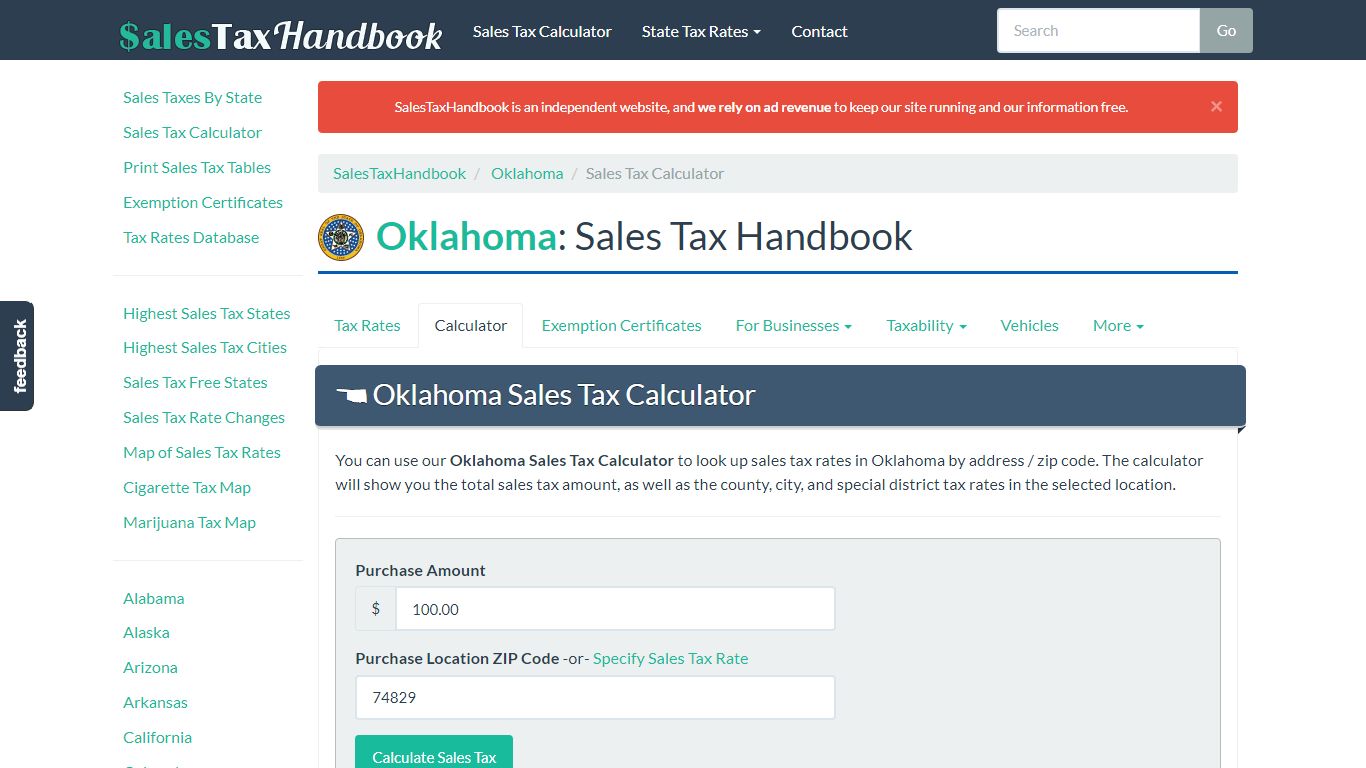

Oklahoma Sales Tax Calculator - SalesTaxHandbook

Oklahoma Sales Tax Calculator You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/oklahoma/calculator

Oklahoma Sales Tax | Calculator and Local Rates | 2021 - Wise

The base state sales tax rate in Oklahoma is 4.5%. Local tax rates in Oklahoma range from 0% to 7%, making the sales tax range in Oklahoma 4.5% to 11.5%. Find your Oklahoma combined state and local tax rate. Oklahoma sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

https://wise.com/us/business/sales-tax/oklahoma

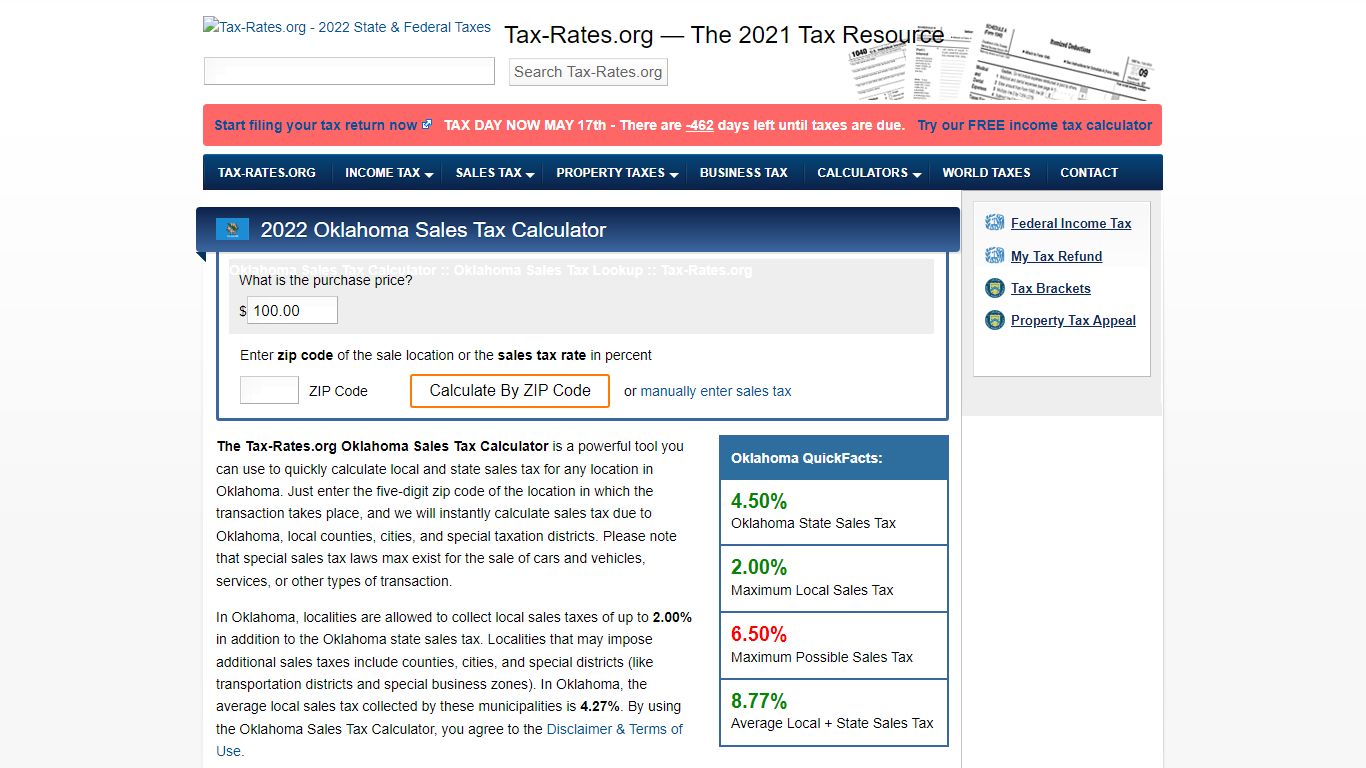

Oklahoma Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Oklahoma, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/oklahoma/sales-tax-calculator?action=preload

Oklahoma Sales Tax Calculator

The Tax-Rates.org Oklahoma Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Oklahoma. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Oklahoma, local counties, cities, and special ...

https://www.tax-rates.org/oklahoma/sales-tax-calculator?action=preload&price=100.00&taxrate=4.50&zip=2022

Oklahoma Sales Tax Rate & Rates Calculator - Avalara

Oklahoma state sales tax rate range 4.5-11.5% Base state sales tax rate 4.5% Local rate range 0%-7% Total rate range 4.5%-11.5% *Due to varying local sales tax rates, we strongly recommend using our calculator below for the most accurate rates. Download state rate tables Get a free download of average rates by ZIP code for each state you select.

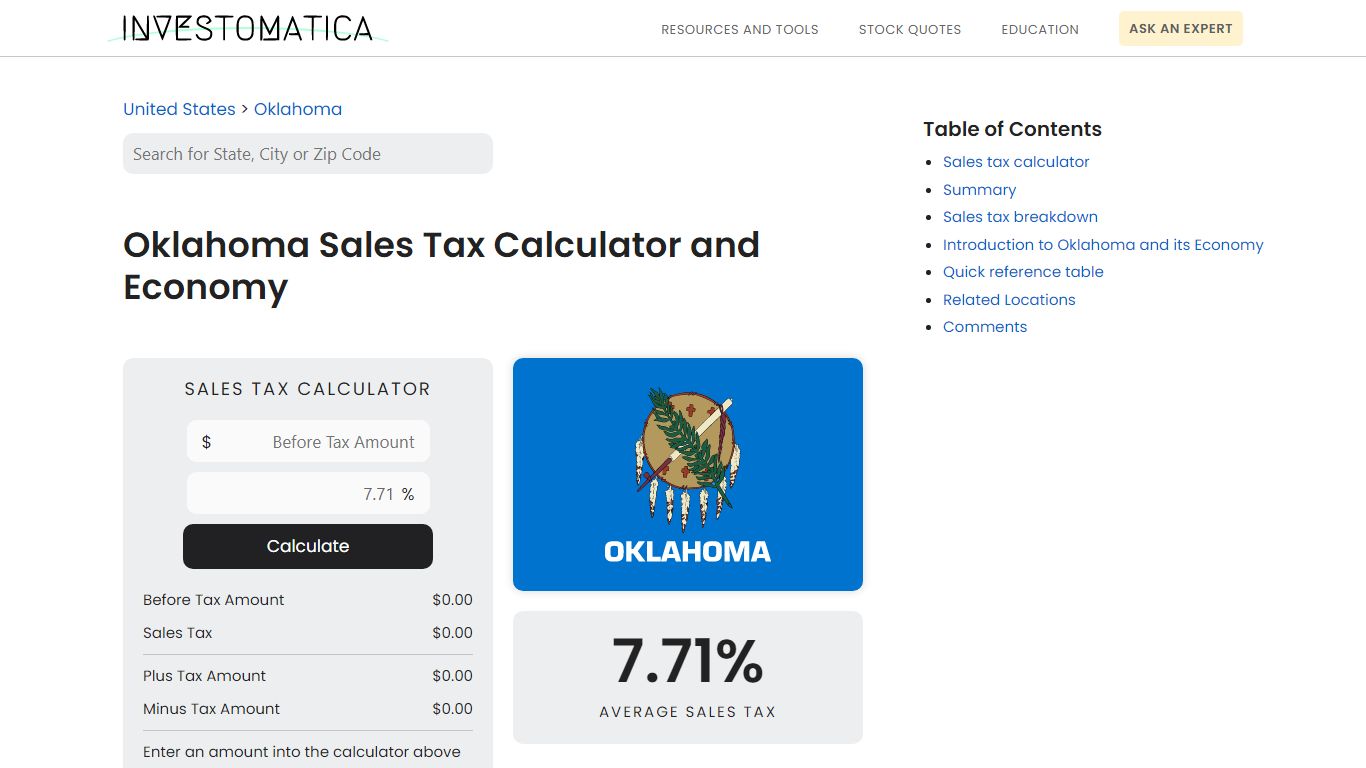

https://www.avalara.com/taxrates/en/state-rates/oklahoma.htmlOklahoma Sales Tax Calculator and Economy - Investomatica

Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Oklahoma. You'll then get results that can help provide you a better idea of what to expect. 7.71% Average Sales Tax Summary The average cumulative sales tax rate in the state of Oklahoma is 7.71%.

https://investomatica.com/sales-tax/united-states/oklahoma

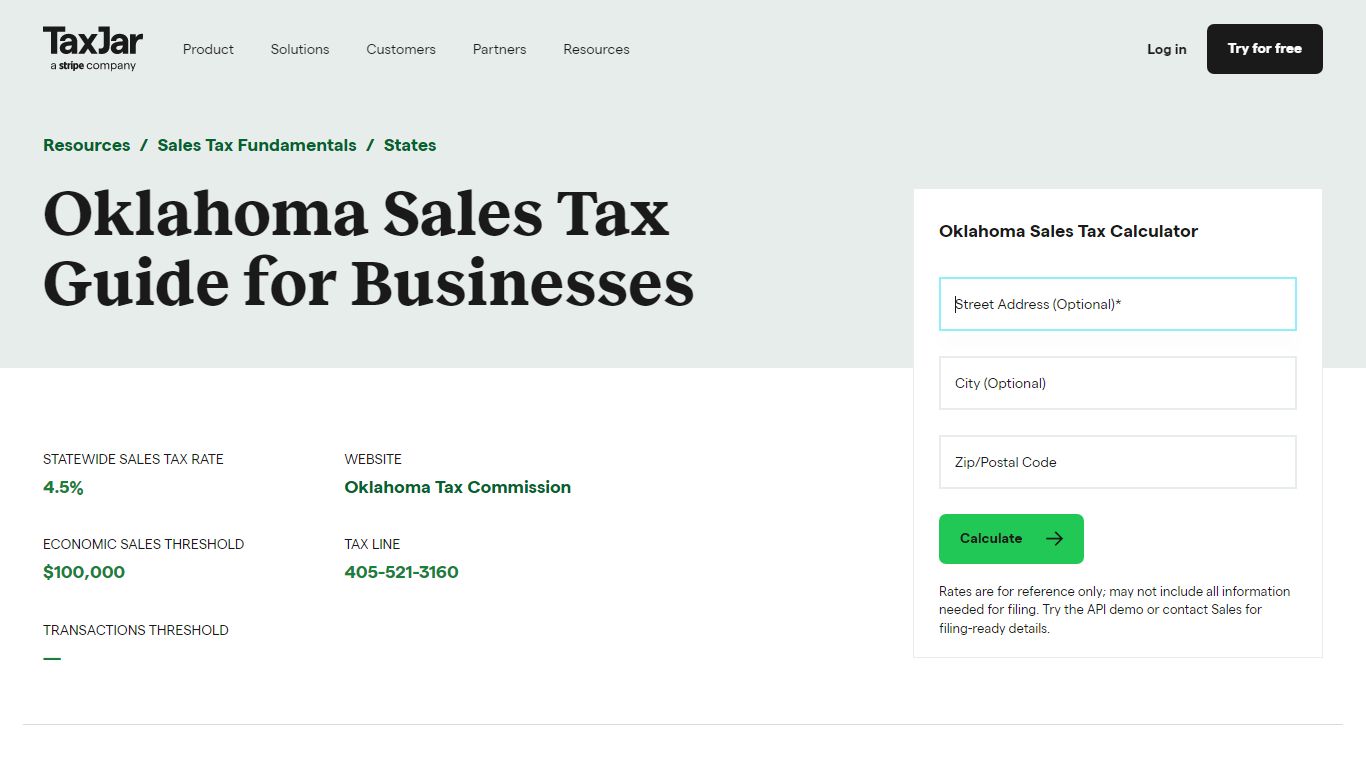

Oklahoma Sales Tax Guide and Calculator 2022 - TaxJar

Oklahoma Sales Tax Guide for Businesses Statewide sales tax rate 4.5% Economic Sales Threshold $100,000 Transactions Threshold — Website Oklahoma Tax Commission Tax Line 405-521-3160 Oklahoma Sales Tax Calculator Calculate Rates are for reference only; may not include all information needed for filing.

https://www.taxjar.com/sales-tax/oklahoma

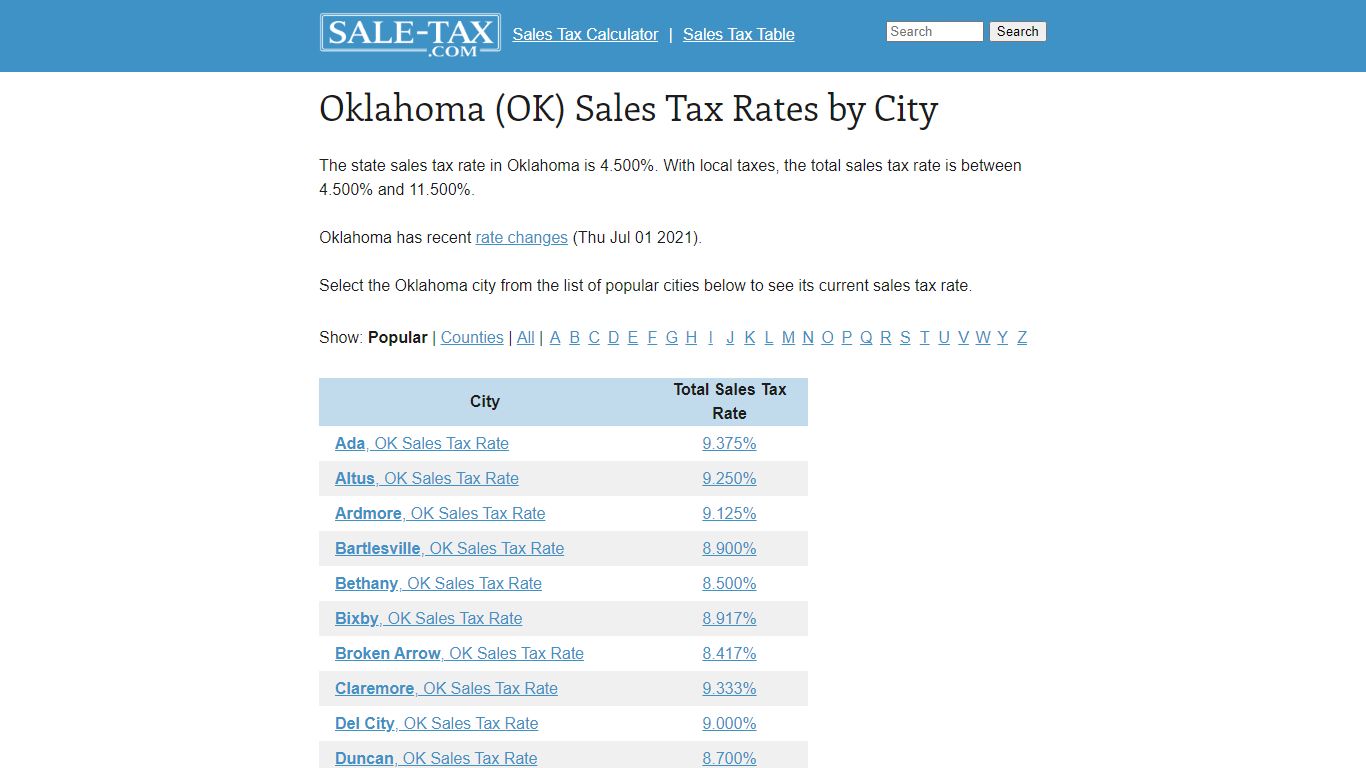

Oklahoma (OK) Sales Tax Rates by City - Sale-tax.com

Oklahoma (OK) Sales Tax Rates by City The state sales tax rate in Oklahoma is 4.500%. With local taxes, the total sales tax rate is between 4.500% and 11.500%. Oklahoma has recent rate changes (Thu Jul 01 2021). Select the Oklahoma city from the list of popular cities below to see its current sales tax rate.

https://www.sale-tax.com/Oklahoma

Oklahoma Vehicle Sales Tax & Fees [+Calculator] - Find The Best Car Price

Calculate Sales Tax in Oklahoma Example (Used Car) Initial Car Price: $20,000 First $1,500 Tax: $20 Remainder Amount to be Taxed at 3.25%: $18,500 Tax for Remaining Amount: $601.25 Total Tax: $601.25 + $20 = 621.25 Total Tax = $20 + [ ($20,000-$1,500) * .0325] Oklahoma Sales Tax Calculator Which County Has the Highest Tax? Which Has the Lowest?

https://www.findthebestcarprice.com/oklahoma-vehicle-sales-tax-fees/![Oklahoma Vehicle Sales Tax & Fees [+Calculator] - Find The Best Car Price](./screenshots/oklahoma-sales-tax-calculator/8.jpg)

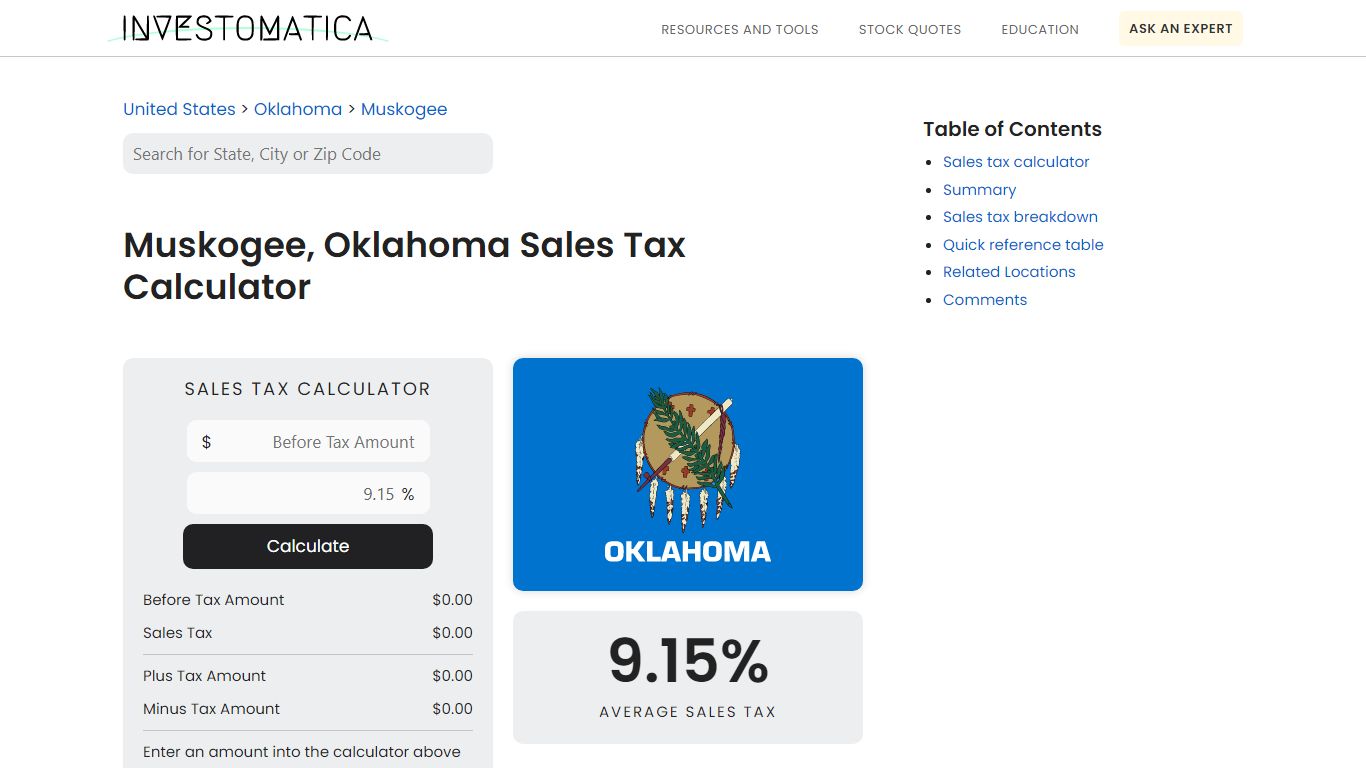

Muskogee, Oklahoma Sales Tax Calculator (2022) - Investomatica

Muskogee, Oklahoma Sales Tax Rate and Calculator 9.15% Average Sales Tax For Muskogee, Oklahoma Summary The average cumulative sales tax rate in Muskogee, Oklahoma is 9.15%. This includes the sales tax rates on the state, county, city, and special levels. Muskogee is located within Muskogee County, Oklahoma.

https://investomatica.com/sales-tax/united-states/oklahoma/muskogee